A Review on Residence and Citizenship

In the realm of global investment opportunities, the concepts of “residency” and “citizenship” often intertwine, providing a range of choices for astute investors looking to broaden their horizons. These programs aim to strengthen the economies of nations while offering foreign investors a valuable asset to enhance their overall wealth: an additional permanent residency or passport.

In an increasingly interconnected world, these assets can unlock doors to greater professional and educational prospects, as well as healthcare and social security benefits.

While both residency-by-investment (RBI), commonly known as Golden Visa programs, and citizenship-by-investment (CBI) offer gateways to new opportunities, it is crucial to comprehend the similarities and differences between the two.

Golden Visa programs entice investors with the prospect of residency in specific countries through qualifying investment channels. These visas provide investors with significant advantages, such as the ability to live, work, and conduct business in their chosen country. In most programs, investor visas also extend to immediate family members, making them even more appealing for global families seeking a wider range of opportunities. Approved visa holders enjoy enhanced travel access, social benefits like excellent healthcare and education, and professional perks, including potential tax incentives. Moreover, this route is typically much faster than traditional applications for permanent residency.

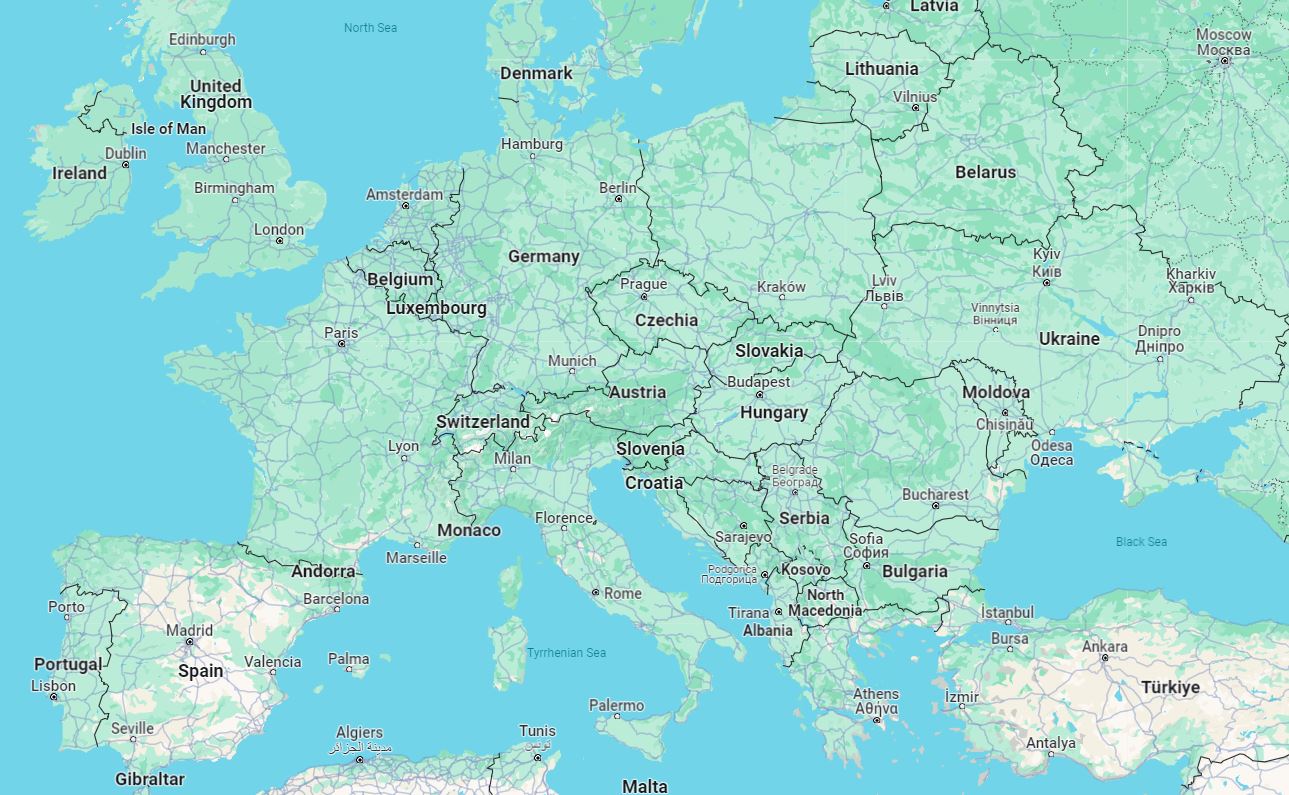

Despite not immediately granting citizenship, a Golden Visa acts as a stepping stone towards permanent residency and, ultimately, citizenship in the selected country. Notably, European countries like Portugal, Spain, Greece, and Latvia offer attractive Golden Visa options, along with a similar EB-5 visa program in the United States.

In contrast to RBI programs, citizenship-by-investment programs are known for their efficiency in granting full citizenship to investors upon approval. Although the qualifying investment for these programs is usually higher, the process is streamlined and expedited, making it the quickest route for investors to obtain multiple citizenships. Consequently, CBI programs have gained a negative reputation for enabling individuals to “buy citizenship.” It is important for investors to exercise caution as acquiring citizenship may subject them to taxation in both their home country and the country they adopt. Nevertheless, for those seeking a permanent solution and a valuable nonfinancial asset, citizenship by investment can be an excellent choice.

Several countries, such as St. Kitts & Nevis, Malta, and Turkey, offer investors and their families immediate passports and the associated privileges that come with full citizenship. Investors can carefully evaluate their options and benefits based on their specific requirements for an additional citizenship.

While both programs provide investors with enhanced global access and numerous opportunities, the key distinction lies in the timeframe for acquiring citizenship status. Golden Visa programs, being the more affordable option, offer a pathway to eventual citizenship through temporary and then permanent residency. In most cases, the duration from program application to citizenship approval can exceed 7 years.

On the contrary, CBI programs offer investors immediate citizenship upon approval, granting them full rights and privileges within a matter of months. In contrast, RBI investments typically carry a higher risk for investors and come with specific requirements that, if not met, could jeopardize the applicant’s permanent residency status or their investment amount, or both.

It is worth noting that the EU has become increasingly opposed to CBI programs, and in many cases, the qualifying investment is in the form of a donation to the government. However, despite the superficial discussions by those unfamiliar with these programs, it is evident that immigrants make significant contributions to the communities they become a part of. Investor immigrants have the potential to stimulate unparalleled economic growth in a country through foreign direct investment and job creation. The government simply needs to establish clear and reliable investment visa programs to direct these investments effectively.

For instance, the US EB-5 investor visa program, which was initiated in 1990, requires the creation of 10 full-time jobs in the American economy as a prerequisite for obtaining permanent residency. Furthermore, the recent revisions made in March 2022 incentivize investments in low-population rural areas by offering priority application processing and a reduced investment amount. This strategic approach channels foreign investment into areas that can benefit the most from it.

With the increasing interconnectedness of the world, it is evident that both RBI and CBI programs will continue to gain prominence as valuable tools for foreign investors. Governments have the opportunity to capitalize on the growing demand for these programs and tailor them to effectively meet the country’s requirements, utilizing direct foreign investment as a crucial instrument. At LCR Capital Partners, we firmly believe that access to global markets and opportunities has the potential to bring about transformative changes in people’s lives. To achieve success, it is essential to comprehend the intricacies of these programs, and we are dedicated to assisting investors in navigating the ever-changing landscape. Consult with a trusted expert and advisor to determine whether RBI or CBI is the right choice for you.

Ana Elisa Bezerra

Senior Director at LCR Capital Partners